Customs Tariff Worldwide: A Complete Guide for Importers & Exporters

Learn about customs tariffs worldwide, types, calculations, HS codes, and country rates. Discover how WOOW helps importers, exporters, and dropshippers save on duties and ship globally.

When you’re running a global business, one of the biggest challenges you’ll face is customs tariff—the tax or duty imposed on goods when they cross international borders. Whether you are a small e-commerce seller, a large-scale importer, or a dropshipper, customs tariffs directly affect your profit margin, product pricing, and delivery timeline.

Understanding customs tariffs is not just about paying taxes—it’s about strategic planning. If you know the rules, you can reduce costs, avoid unnecessary delays at customs, and build a more sustainable international business. Many companies fail in global trade simply because they underestimate the impact of tariff regulations, HS codes, and hidden charges.

At WOOW, we believe that transparency and knowledge are the keys to successful international shipping. Our mission is to make global trade simpler, smarter, and more affordable for businesses and individuals worldwide. That’s why we’ve created this guide: to help you clearly understand what customs tariffs are, how they work, and how you can minimize their impact on your shipments.

In this article, you’ll discover:

- What a customs tariff actually means in global trade

- How countries calculate tariffs using HS Codes & CIF value

- The difference between ad valorem and specific duties

- Customs tariff structures in the USA, EU, China, Bangladesh, UAE, and more

- Practical tips to save money and avoid common mistakes

- How WOOW’s services make shipping easier by guiding you through the customs process

By the end of this guide, you’ll not only understand the basics of customs tariffs worldwide, but also learn how to make smarter business decisions when importing or exporting goods.

What is a Customs Tariff?

A customs tariff (also called customs duty, import duty, or tariff) is a tax imposed by a government on goods that are imported into or exported out of a country. It is one of the oldest and most common forms of taxation in international trade.

The tariff is usually calculated as a percentage of the total value of the goods, or in some cases, as a fixed charge per unit/weight. This cost is typically paid by the importer (the person or business bringing in goods), although in reality, it is often passed on to the end consumer in the final product price.

Main Objectives of Customs Tariffs

A customs tariff is not just a tax—it serves multiple strategic purposes in international trade and national economic policy. Below are the key objectives explained in detail:

1. Regulating International Trade

Customs tariffs help governments control the inflow and outflow of goods. By imposing higher tariffs on certain items, a country can limit imports of those products and protect its own economy. On the other hand, lowering tariffs can encourage trade partnerships with specific countries.

Example: If a country wants to reduce the import of luxury cars, it may impose a high customs duty to discourage foreign brands from flooding the local market.

2. Protecting Domestic Industries

One of the primary reasons for tariffs is protectionism. Local manufacturers often struggle to compete with cheaper imported goods. By applying tariffs, governments make imported goods more expensive, which allows domestic industries to thrive and sustain employment.

Example: A developing country may impose tariffs on imported garments to protect its own textile industry and encourage consumers to buy locally-made clothes.

3. Encouraging Local Production

When foreign goods become expensive due to high tariffs, domestic producers gain a competitive advantage. This stimulates local investment, manufacturing, and innovation. Governments often use tariffs as a tool to promote self-sufficiency and reduce dependency on foreign goods.

Example: High tariffs on imported dairy products encourage farmers and companies to increase local milk production.

4. Generating Government Revenue

Customs tariffs are a major source of revenue for governments, especially in developing countries where tax collection systems are not very strong. Import duties provide steady income that governments can use for infrastructure, healthcare, education, and public services.

Example: In many Asian and African countries, customs duties make up a large portion of the national budget.

In summary: Customs tariffs are not just about raising money—they are a powerful economic policy tool that shapes trade, protects jobs, and supports local industries.

Types of Customs Tariffs

Customs tariffs are not the same everywhere. Different countries use different tariff systems. Below are the three most common types you need to know:

1. Ad Valorem Tariff

- This is the most widely used tariff system.

- It is calculated as a percentage of the product’s value.

- Example: If the ad valorem tariff is 10%, and your imported goods are worth $1,000, the tariff payable will be $100.

Commonly applied on electronics, apparel, and consumer goods.

2. Specific Tariff

- This is a fixed fee per unit, weight, or volume of the goods.

- Example: If the specific tariff is $50 per kilogram, and you import 100 kg of goods, the tariff payable will be $5,000.

Often applied on bulk items such as oil, coal, grain, and raw materials.

3. Compound Tariff

- A combination of ad valorem + specific tariff.

- Example: If the tariff rate is 10% ad valorem + $20 per unit, and you import 100 units valued at $1,000, the total tariff would be:

- 10% of $1,000 = $100

- $20 × 100 units = $2,000

- Total Tariff = $2,100

Commonly applied on cars, luxury goods, and regulated products.

Pro Tip for Businesses:

If you are importing goods, always check the HS Code (Harmonized System Code) of your product, because the customs tariff is directly linked to it. Two similar products might fall under different HS codes and have very different tariff rates.

How Customs Tariffs Are Calculated

Understanding how customs tariffs are calculated is essential for importers, exporters, and dropshippers. The final duty amount is not just a flat fee—it depends on multiple factors such as product classification, shipping cost, and tax regulations. Here are the main steps:

1. HS Code (Harmonized System Code)

- Every product traded internationally is assigned a unique HS code (6–10 digits).

- Customs authorities use this code to determine the tariff rate, restrictions, or exemptions for your product.

Example: A cotton T-shirt and a polyester T-shirt fall under different HS codes, which means the duty rate can vary significantly.

SEO Tip: Always check the correct HS code for your product—misclassification can lead to higher duties, fines, or shipment delays.

2. Customs Value (CIF Method)

- Most countries calculate customs duty on the CIF value:

- CIF = Cost of Goods + Insurance + Freight (shipping cost)

- The higher the CIF value, the higher the customs duty payable.

Example: If your goods cost $5,000, insurance is $200, and freight is $300 → CIF value = $5,500.

- If the duty rate is 10%, the payable duty = $550.

3. Type of Tariff Applied

Customs tariffs are usually of three types:

- Ad Valorem Duty → Percentage of product value (e.g., 10% of $1,000 = $100).

- Specific Duty → Fixed charge per unit, weight, or volume (e.g., $50 per kg).

- Compound Duty → A mix of both (e.g., 10% of $1,000 + $20 per unit).

Knowing which tariff applies helps you accurately calculate the landed cost of goods.

4. Extra Charges and Taxes

Beyond customs duty, most countries add additional import taxes, such as:

- VAT (Value Added Tax) – Common in Europe & Asia (ranges 5%–25%)

- Excise Duty – Applied to luxury or restricted goods (alcohol, tobacco, cars)

- Handling & Processing Fees – Charged by customs or shipping companies

Example: Importing a car into the EU may involve customs duty + VAT + excise duty, making the final price much higher than the purchase price.

Pro Tip for Importers & Exporters:

Always calculate the landed cost before shipping, which includes:

Product Cost + Freight + Insurance + Customs Duty + VAT/Taxes + Handling Charges.

This ensures you know the true cost of your product before it reaches the market.

Country-Wise Customs Tariff Overview

United States

- Tariff rates: 0%–20% (average depends on product)

- No VAT, but state sales tax may apply after import

- HS Code–based classification system

European Union (27 Countries)

- Common external tariff across all EU members

- Import duty: 0%–17%, higher on textiles & agriculture

- Import VAT: 19–25% depending on the country

China

- Import tariff: 0%–50%

- Consumption tax applies to luxury goods (cars, alcohol, cosmetics)

- Export tariffs on restricted goods such as steel and rare earth minerals

Bangladesh

- Import duty: 0%–25% on most items

- VAT: 15% standard rate

- Additional supplementary duties on luxury items and cars

United Arab Emirates (UAE)

- Low tariffs, average 5%

- Excise duty up to 100% on alcohol, tobacco, and soft drinks

- Free zones allow duty-free re-export of goods

India

- Import duty: 0%–40%, depending on product category

- GST (Goods and Services Tax) also applies (5%–28%)

- Higher tariffs on electronics, gold, and luxury products to protect local industry

Japan

- Average import tariff: 0%–15%

- Many industrial goods: duty-free due to trade agreements

- Agricultural products (rice, dairy, beef) face very high tariffs to protect farmers

Canada

- Import duty: 0%–20%

- Imports are also subject to GST (5%) or HST (up to 15%) depending on province

- Many goods from the US and Mexico are duty-free under CUSMA (NAFTA 2.0)

Australia

- Low tariff system, most goods: 0%–5%

- Imports subject to GST (10%)

- Trade agreements with Asia-Pacific countries reduce tariffs further

Brazil

- Import duty: 10%–35% (one of the highest in the world)

- ICMS (value-added tax) also applies, rate varies by state (17%–25%)

- Strong protectionism for local industries, especially in manufacturing

South Africa

- Import tariffs: 0%–30%

- VAT: 15% standard rate

- Higher tariffs on vehicles, textiles, and luxury goods

FAQs on Customs Tariffs

Q1. How do I find the customs tariff for my product?

Finding the correct customs tariff begins with identifying the HS Code (Harmonized System Code) of your product. Every internationally traded product has a unique code, which determines the duty rate, restrictions, and potential exemptions.

- Step 1: Identify the product’s material, function, and use. For example, cotton T-shirts and polyester T-shirts have different HS codes.

- Step 2: Use the official customs website of the destination country or a reliable online customs duty calculator.

- Step 3: Verify if any trade agreements or preferential tariffs apply to your country of origin.

Pro Tip: Misclassifying HS codes can lead to overpayment, shipment delays, or even legal fines, so always double-check.

Q2. Do I have to pay customs duty on dropshipping?

Yes, in most cases. Even if you are dropshipping, customs duties and taxes are typically the responsibility of the buyer or importer.

- If you ship directly from a supplier abroad, local customs authorities may require payment of import duty, VAT, or other taxes before delivery.

- Some eCommerce platforms allow prepaid customs fees, which can improve customer experience by preventing last-minute surprises.

- WOOW provides guidance on estimating landed costs, helping you include customs duty in your product pricing.

Example: Shipping a $50 product from the USA to Europe may incur 10% import duty + 20% VAT. The customer could end up paying almost $65–70 if these fees are not pre-calculated.

Q3. Can customs duty be avoided?

While customs duty is legally required, some strategies can help reduce or manage the cost:

- Free Trade Agreements (FTA): Certain countries allow reduced or zero tariffs for specific products. For instance, goods shipped from Mexico to the USA under CUSMA/NAFTA may have lower duties.

- Tax-Free or Duty-Free Shopping: Services like WOOW help legally reduce tariffs by shipping through tax-free US warehouses or free-trade zones.

- Small Parcel Exemptions: Many countries have a minimum value threshold below which no duty is charged.

Caution: Attempting to misdeclare goods or hide value is illegal and may lead to confiscation or heavy fines.

Q4. What is the difference between customs duty and VAT?

- Customs duty: A tax on imported/exported goods to regulate trade and protect local industries. Calculated based on the CIF value (Cost + Insurance + Freight) or a fixed unit rate.

- VAT (Value Added Tax): A consumption tax applied on goods and services, usually added after customs duty. It is a standard percentage of the total value including duty.

Example: Importing electronics worth $1,000 with 10% duty and 20% VAT:

- Customs duty = $100

- VAT = 20% of ($1,000 + $100) = $220

- Total payable = $320

This distinction is critical for accurate landed cost calculations.

Q5. What is a HS Code and why is it important?

The Harmonized System Code (HS Code) is a standardized international product classification system.

- Determines the tariff rate, eligibility for exemptions, and compliance requirements.

- Ensures uniformity in global trade, reducing confusion for customs officers worldwide.

- Misclassification can result in higher duties, delays, or legal penalties.

Example: A smartphone and a smart home device may look similar but fall under different HS codes, with duty rates ranging from 0% to 15%.

Q6. How is customs duty calculated?

Customs duty depends on several factors:

- CIF Value (Cost + Insurance + Freight): Most countries calculate duty on this value.

- Type of Tariff: Ad Valorem (percentage), Specific (fixed per unit), or Compound (mix of both).

- Extra Charges: VAT, excise duty, and handling fees.

Example: Importing 100 units of a gadget worth $1,000 each, with a compound duty of 10% ad valorem + $20/unit:

- Ad valorem = 10% of $100,000 = $10,000

- Specific = $20 × 100 units = $2,000

- Total customs duty = $12,000

This shows why accurate calculation is essential for pricing and profit margins.

Q7. Can I get a customs duty refund?

Yes, in certain situations:

- Returned goods: Items sent back to the supplier may qualify for a refund.

- Re-exported products: Goods that leave the country again often allow partial or full duty recovery.

- Overpaid duties: If the HS code was misclassified or the CIF value was overestimated, you can claim a refund from customs.

Note: Always maintain proper documentation and invoices to support refund claims.

Q8. Are all products taxed equally?

No. Tariff rates vary depending on:

- Product category: Electronics, textiles, luxury items, and raw materials have different rates.

- Country of origin: Products from certain countries may have preferential duty rates under trade agreements.

- HS Code: Two similar items may fall under different HS codes, resulting in different duty rates.

Example: Cotton T-shirts from India may attract 10% duty, whereas polyester T-shirts from China may attract 15%.

Q9. What happens if I under-declare the value of my goods?

- Customs authorities may impose fines, penalties, or confiscate goods if they detect undervaluation.

- You may face legal action or delay in customs clearance.

- Always declare the actual CIF value and include shipping and insurance costs.

Tip: Transparency with customs ensures smooth delivery and avoids extra costs.

Q10. How can businesses minimize customs costs?

- Use accurate HS codes for classification.

- Leverage FTAs and duty exemptions.

- Consolidate shipments to reduce handling fees.

- Use tax-free or free-zone services like WOOW for eligible products.

- Negotiate with suppliers to include customs duties in the landed cost.

Example: Bulk shipping 500 units in one shipment may cost less than five separate shipments of 100 units each due to reduced per-unit handling fees.

Q11. Do customs tariffs apply to gifts or personal items?

- Many countries have minimum value thresholds for personal imports.

- Gifts above this threshold may be subject to customs duty, VAT, or excise taxes.

- Some courier services allow you to declare items as gifts, which can reduce or delay tax payment—but beware of local regulations to avoid fines.

🚀 How WOOW Helps You

At WOOW, we understand that navigating customs tariffs, import duties, and international regulations can be confusing and time-consuming. That’s why we provide end-to-end solutions for businesses and individuals shipping globally. Here’s how we make it easier:

1. Accurate Customs Guidance

- We provide up-to-date information on customs tariffs, import duties, and country-specific regulations.

- Our experts help you calculate landed costs before shipment, so you know the total price upfront.

- This reduces surprises and ensures compliance with local laws.

2. Proper HS Code Classification

- Misclassification of products can lead to higher duties or shipment delays.

- WOOW helps you identify the correct HS Codes for your products, ensuring smooth customs clearance.

- Example: Electronics, textiles, or luxury goods all have unique HS codes that determine duty rates.

3. Tax-Free Shopping from the USA

- Certain products can be shipped from the USA duty-free or tax-free under specific conditions.

- WOOW helps you leverage this opportunity to save on import duties, reducing your overall costs.

- This is especially beneficial for dropshipping, eCommerce businesses, and personal imports.

4. Full Customs Paperwork Support

- WOOW handles all the necessary customs documentation, including invoices, packing lists, and declarations.

- By managing paperwork accurately, we ensure that your shipments move smoothly through customs without delays or fines.

- This saves you time, reduces errors, and avoids unnecessary stress.

Final Thoughts

Customs tariffs are an unavoidable aspect of international trade, but with the right knowledge and a reliable partner like WOOW, you can:

- Minimize import duties and extra charges

- Avoid delays or legal complications at customs

- Ensure your business grows smoothly in the global market

Whether you’re importing products for resale, personal use, or dropshipping, WOOW makes global shipping simple, transparent, and cost-effective.

By combining accurate customs guidance, HS Code classification, tax-free shopping options, and full documentation support, WOOW ensures your shipments reach their destination quickly and hassle-free.

Related Articles

How to Buy USA Products Online & Get Door-to-Door Delivery in Bangladesh

Learn how to buy USA products online from any US website. Save tax using Delaware address, ship via Woow Global, and receive within 12–15 days in Bangladesh.

How to Ship Amazon Products from USA to Bangladesh – Safe & Easy Method

Learn how to ship Amazon products from USA to Bangladesh safely. Get a tax-free USA address, fast delivery, and full customs handling with WOOW. No hidden charge.

USA to Bangladesh Shopping and Shipping Tax-Free by Woow Global – Trusted Service

Woow Global offers tax-free USA to Bangladesh shopping and shipping with no hidden charges. Buy from Amazon, Walmart, eBay and ship safely to Bangladesh at a low cost.

Garments Export from Bangladesh: Fast & Affordable Air Shipping with Woow Global

Ship garments from Bangladesh fast and affordably with Woow Global. Enjoy reliable air shipping, door-to-door export delivery, and trusted global logistics support.

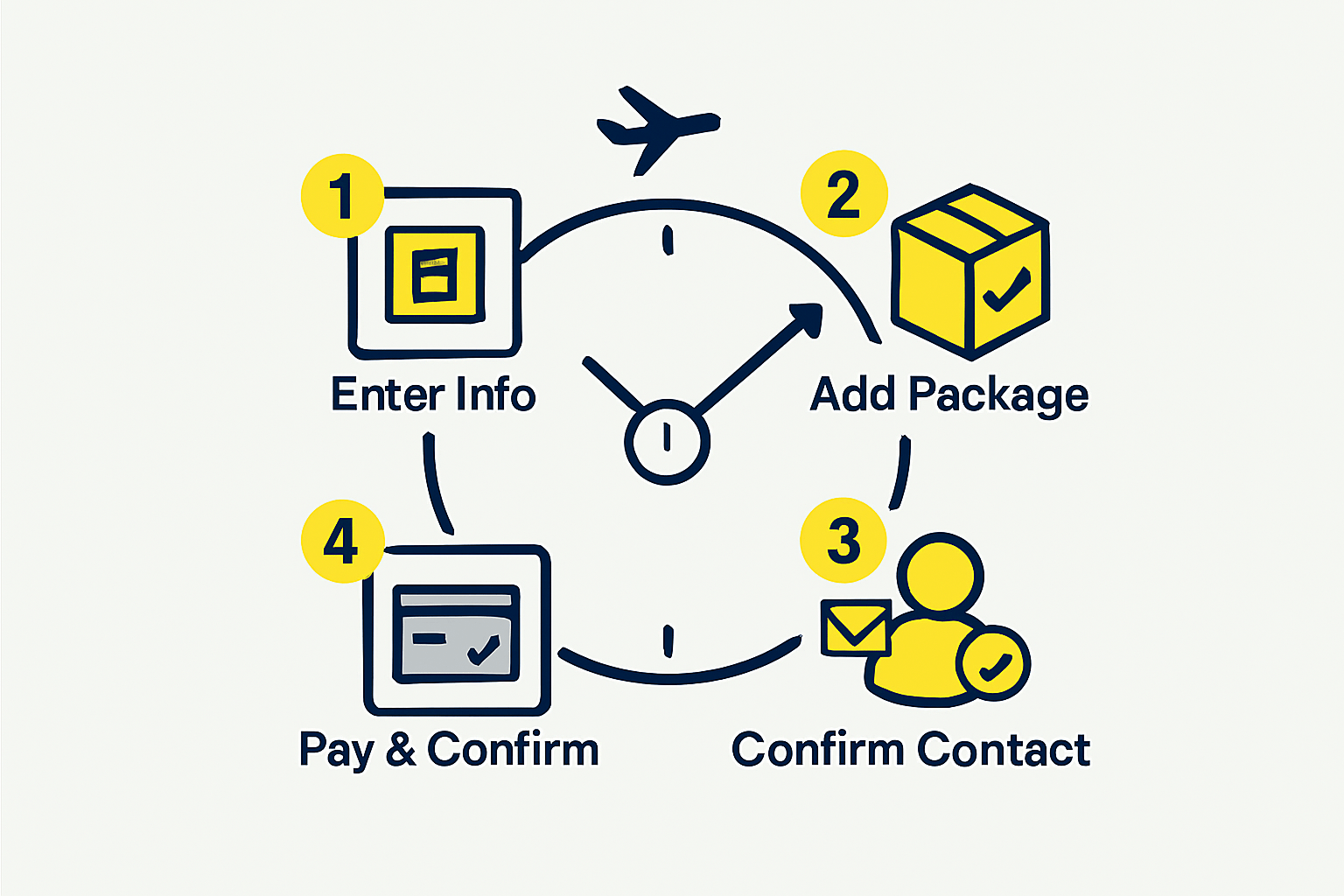

Effortless Shipping: How to Place the Perfect Order with Woow Global

Learn how to place the perfect shipping order with Woow Global. A step-by-step guide for effortless international shipping, package tracking, and secure delivery.